-

-

Key features

-

© 2025 Copyright Planning Pod. All Rights Reserved.

See why over 70,000 event professionals rely on our event floor plan software to design their events

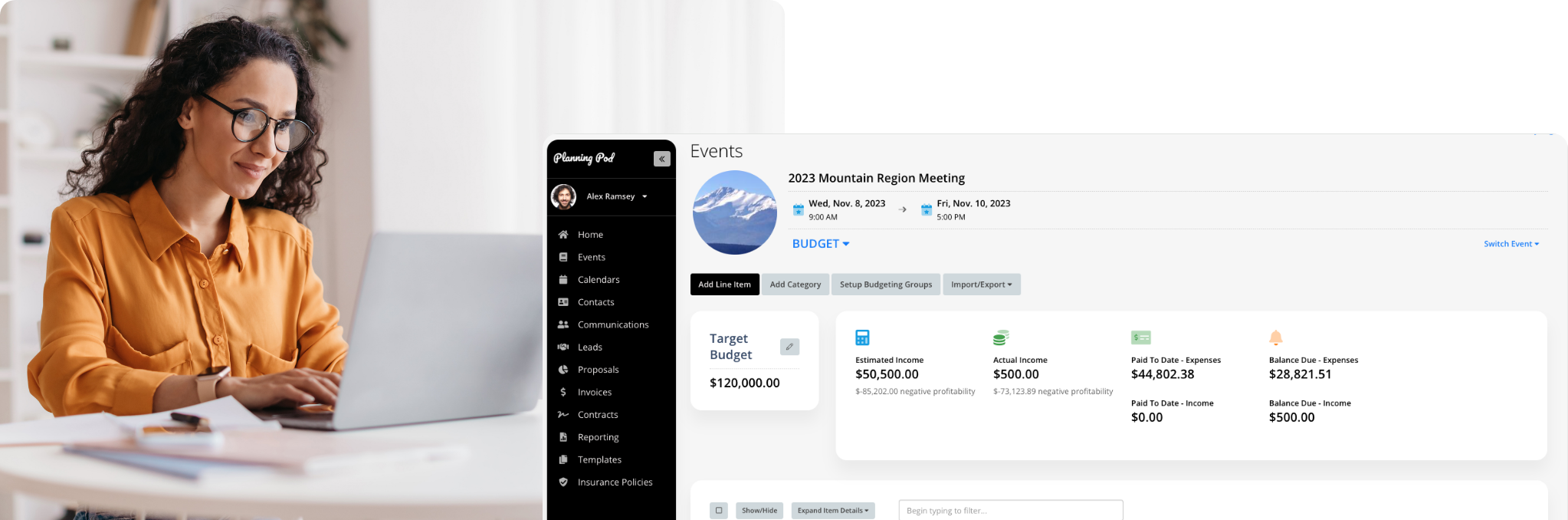

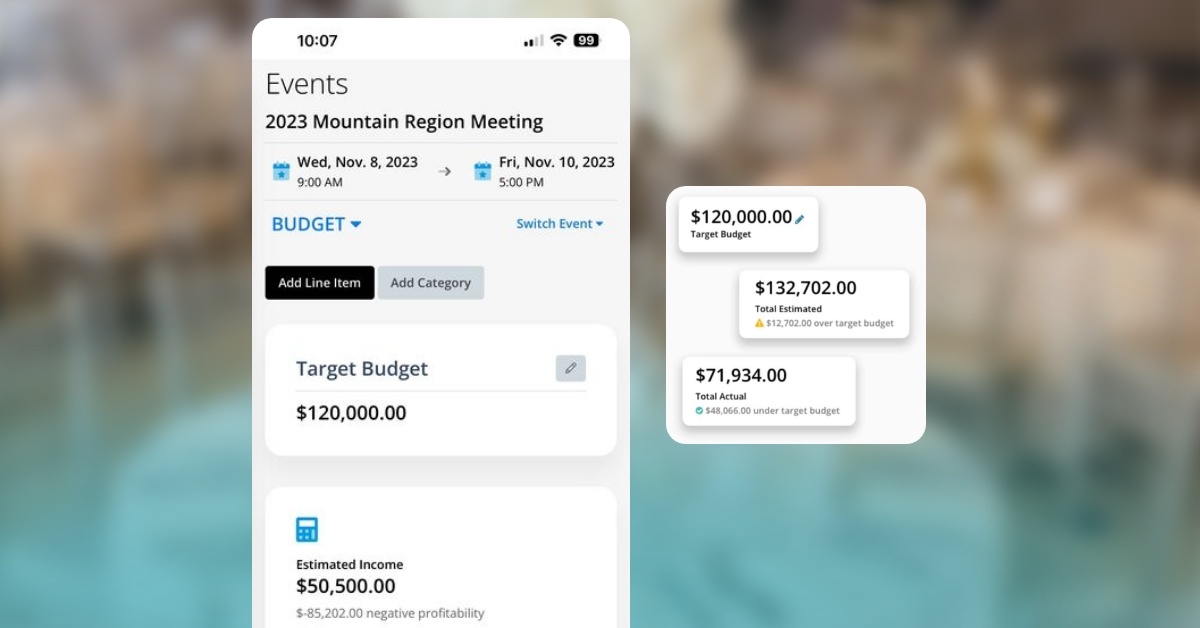

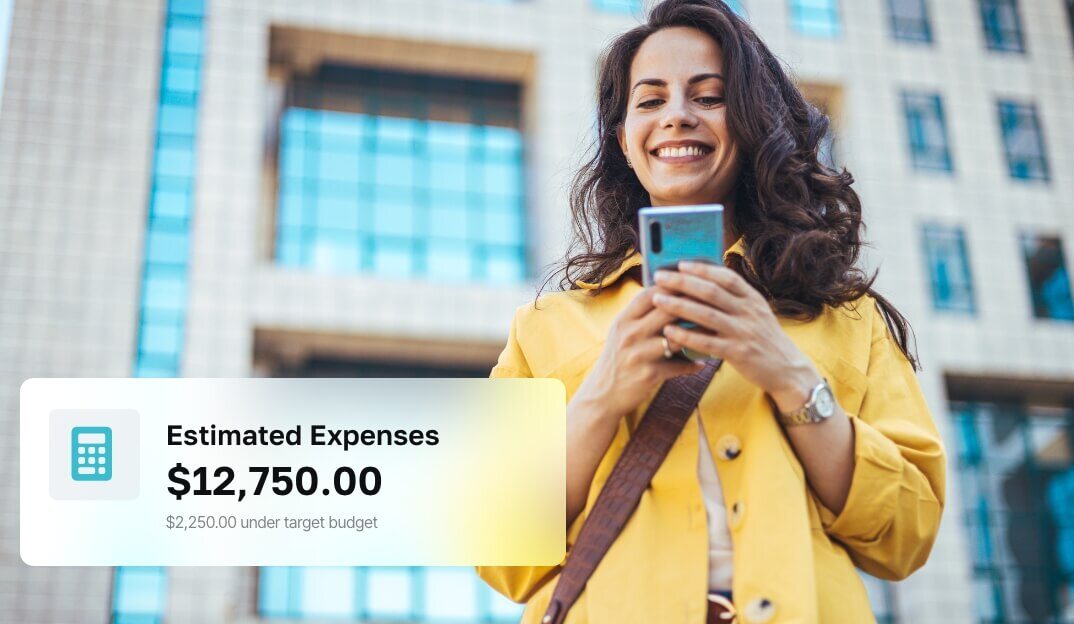

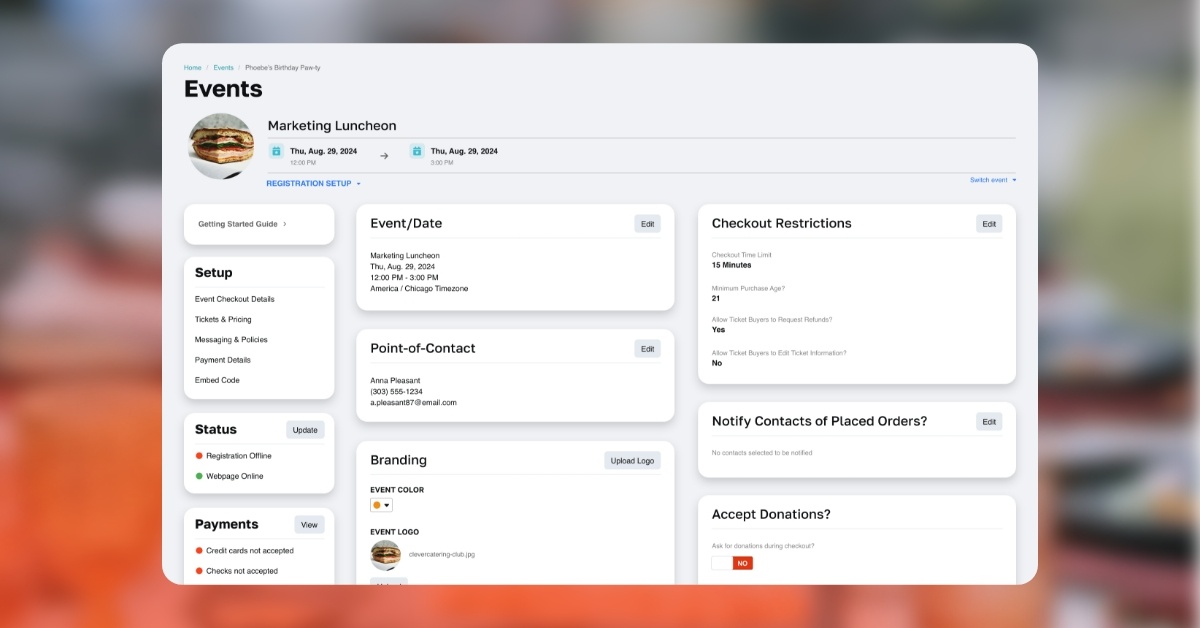

Our cloud-based event budget planner can be used via the Web browser on any device - smartphones or tablets, desktops or laptops.

© 2025 Copyright Planning Pod. All Rights Reserved.